Use the EBICS TS protocol to secure your banking exchanges

What is the EBICS TS protocol?

EBICS was first introduced in 2006. Its aim was to transform a protocol that had become obsolete into something more reliable and easy to use. EBICS is used mainly in Europe, and was developed by German, Swiss, and French banks to replace the ETEBAC protocol. Today, it is widely adopted by all financial institutions.

It facilitates and secures the transfer of financial flows between companies, customers and banks. Given the sensitivity of the data circulating, the system must meet the security requirements of both companies and financial institutions. There are several versions, the most recent being EBICS TS (Transport and Security), which is more effective against fraud.

EBICS T did not secure the signature certificate, as this was the responsibility of the bank. With the TS profile, the signature certificate is secured.

![AdobeStock_293228751 [Converti] copie](https://wp-axelor.web01-dev-it.axelor.com/wp-content/uploads/2022/07/illu_ebics_01.jpg)

![AdobeStock_279975720 [Converti] copie](https://wp-axelor.web01-dev-it.axelor.com/wp-content/uploads/2022/07/illu_ebics_02.jpg)

How does the EBICS TS protocol work?

The EBICS TS protocol uses secure communication based on HTTPS (Hypertext Transfer Protocol Secure) to transport data between business computers and bank servers. Here’s an overview of how it works:

1

Authentication: When a company establishes a connection to a bank server, it must authenticate itself using a digital certificate. This is issued by the financial institution and contains unique identification information for the employer.

2

Key exchange: After this first step, the company and bank computers exchange keys to establish a secure exchange.

3

File transmission: Once the secure exchange has been established, the organizations can send banking transaction documents such as payments, direct debits or account statements. Files are generally in XML, CSV or TXT format. They are digitally signed by the company to guarantee their authenticity and integrity.

4

Receiving and processing files: The bank server receives the files sent by the company and processes them according to specified instructions. For example, in the case of a payment, the bank server checks that the company's account has the necessary funds.

5

Confirmation: Once the bank server has processed the files, it sends a confirmation to the company indicating whether the transaction has been accepted or rejected. Confirmations are generally sent in XML format.

Companies can carry out transactions securely and in real time. This saves time and reduces costs.

What are the benefits of the EBICS TS protocol?

The EBICS TS solution offers a number of benefits:

- Increased protection: a secure connection based on the HTTPS rule, which encrypts data and prevents it from being intercepted by malicious third parties. The digital certificates used for encryption also guarantee t

- Speed and efficiency: companies can carry out transactions electronically and in real time, saving time and reducing costs compared with SWIFT in particular.

- Flexibility: EBICS TS supports different formats such as XML, CSV and TXT, enabling companies to work with their own systems and data formats.

- Traceability: allows you to track the history of transactions, and keep precise track of all those carried out.

- International compatibility: used in several European countries and recognized by banks worldwide, facilitating international exchanges.

How can you secure your payment processes with an EBICS TS contract?

To secure payment processes, it’s important to implement appropriate security measures to protect data and prevent fraud. Here are a few best practices to follow:

Use security certificates: These are essential to secure trading. Signature and authentication certificates ensure that only authorized parties can access and manipulate data.

Reinforce access controls: Users must be properly authenticated before they can access payment functions. Strong passwords, two-factor encryption, tokens and the management of roles and access privileges are essential measures to reinforce login security.

Establish auditing processes: Internal verification processes must be put in place to validate trades and ensure they comply with company policies.

Monitor activities: Ongoing monitoring of payment activities is essential to detect fraudulent or suspicious behavior. Transactions should be checked for unusual activity, such as large amounts or unknown payment destinations.

Staff training: Employees must be trained in the best practices of professional regulation. Data protection awareness and training on remittance procedures are essential measures to prevent errors and fraud.

What’s the difference between EBICS TS and SWIFT?

EBICS TS and SWIFT are two communication processes used for international banking transactions, but they differ in several respects.

EBICS TS (Electronic Banking Internet Communication Standard transport and security) is used for exchanges between companies and banking organizations, enabling the transport of financial data via the Internet, including payments and account statements, in an automated and secure way. It uses security certificates to guarantee data confidentiality and integrity, and user IDs for authentication.

SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a global interbank communication network used to process international payments and financial messages. SWIFT facilitates exchanges between banks and financial institutions worldwide, using a set of standards and standardized messages for funds transfers and treasury operations. It also uses security certificates to guarantee data confidentiality and integrity, and user IDs for authentication.

The main difference between the two protocols is that EBICS TS is mainly used for transactions within Europe, whereas SWIFT is used worldwide. In addition, EBICS TS is used more for real-time online payments, while SWIFT is used for international contracts and financial messages. Finally, EBICS TS is often considered simpler and faster to implement than SWIFT, which can be more complex due to the diversity of international standards and regulations.

What is the link between EBICS TS and accounting?

The use of EBICS TS can be an important element in accounting management, as it can simplify and automate certain accounting tasks, while offering greater visibility over cash flow.

By using this protocol for expenses, companies can automate certain accounting orders, such as entering supplier invoices and reconciling payments received. Exchanges are also secure and traceable, making it easier to audit financial operations.

What’s more, it facilitates communication between financial institutions and companies, offering greater visibility of cash movements in real time.

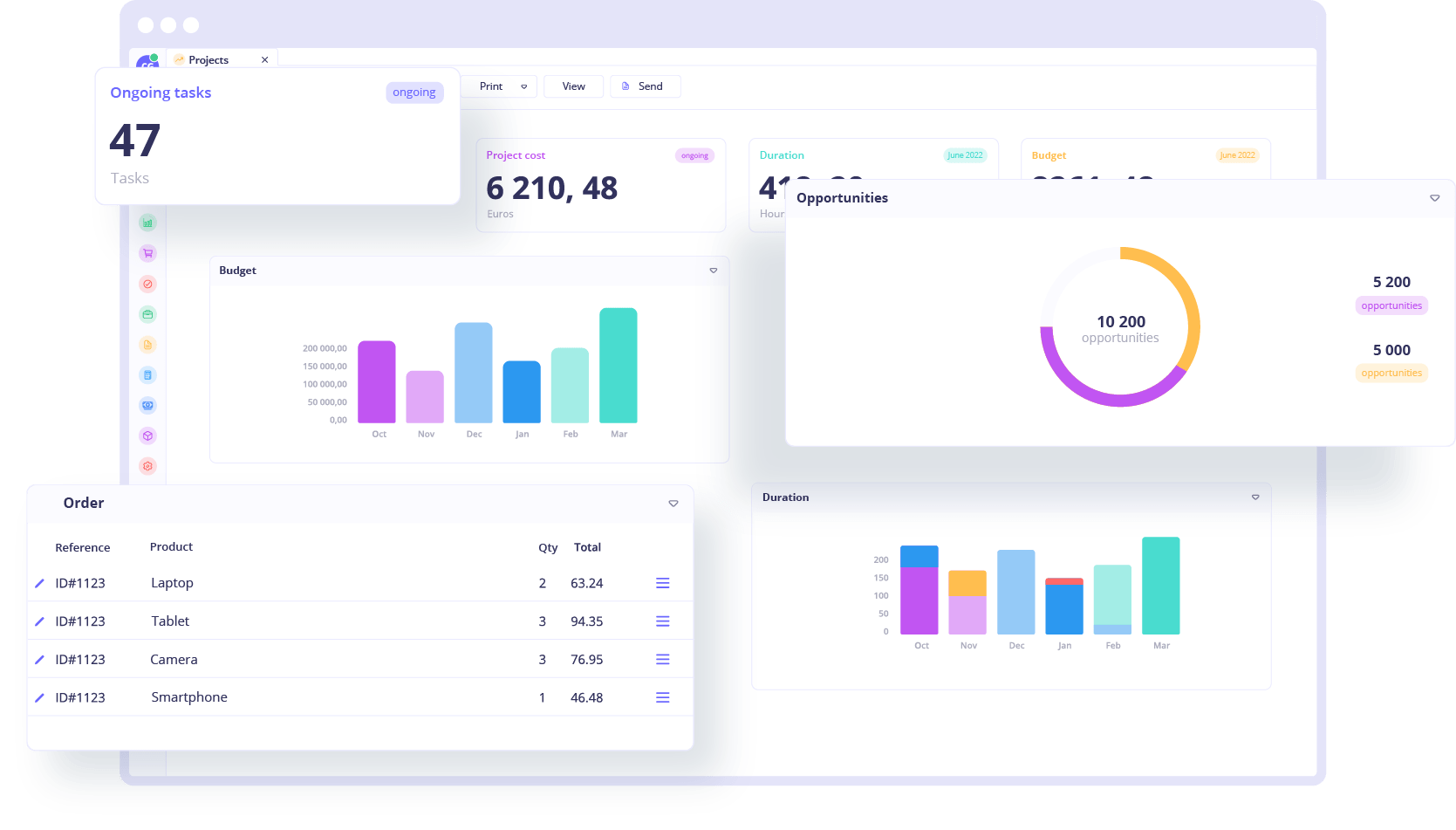

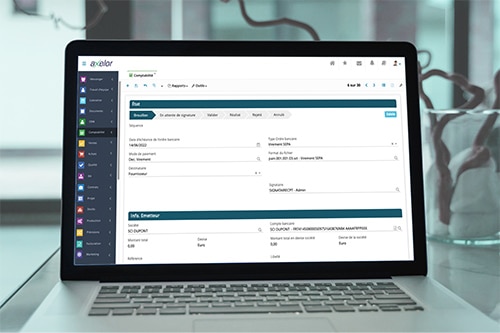

EBICS TS is natively integrated into Axelor

Axelor ERP includes the validation workflow and all the steps required to integrate the protocol. These steps involve retrieving data such as validation certificates from the bank. Once integrated, the system retrieves the bank statements. The process is implemented upstream, according to the company’s needs.

Using EBICS in Axelor ERP

• Direct bank transfers and direct debits from ERP, without intermediaries

• Automatic retrieval of account statements

• Simultaneous processing of multiple orders

• SEPA and international transfers

• Transfer of payment and collection files

• Electronic signature of payments with acknowledgement of receipt

Our partner banks

Axelor has already implemented the protocol with a number of banks, and the list is growing rapidly.