EBICS TS Protocol

A secure and convenient protocol: unlock the advantages of EBICS TS for your banking transactions.

Understanding EBICS TS

Before presenting EBICS, let’s go over its origins. The EBICS protocol was introduced in 2006. Its purpose was to transform a protocol that was obsolete into something more reliable and easy to use. EBICS has become an international, scalable, and safe protocol. Nowadays, this protocol has become widely adopted by all financial institutions.

![AdobeStock_293228751 [Converti] copie](https://wp-axelor.web01-dev-it.axelor.com/wp-content/uploads/2022/07/illu_ebics_01.jpg)

EBICS is a system that facilitates and secures financial transfers between companies, customers, and banks. Given the privacy of the circulating data, the system must meet the security requirements of companies and banks. The protocol has thus evolved in its protection standards by becoming EBICS TS and being more effective against fraud. The EBICS TS protocol does not secure the signature certificate, as the responsibility rests with the bank. With the TS profile, the signature certificate is protected.

![AdobeStock_279975720 [Converti] copie](https://wp-axelor.web01-dev-it.axelor.com/wp-content/uploads/2022/07/illu_ebics_02.jpg)

Who Is It Intended For?

EBICS protocol is intended for companies that need regular and secured exchanges with their bank in order to facilitate transfers. Exchanges are systematically initiated by the customer, whether to or from the bank. EBICS can be used with the banks that are associated with the system, on an international basis.

![AdobeStock_142276396 [Converti] copie](https://wp-axelor.web01-dev-it.axelor.com/wp-content/uploads/2022/07/illu_ebics_03.jpg)

What can I do with EBICS process?

The advantages of EBICS TS

EBICS protocol allows to optimize transactions and save time on tasks connected to banking exchanges. Here is an overview of its advantages:

☑ EBICS is easy to set up and safe

☑ The costs are lower than SWIFT

☑ Exchanges with EBICS have no additional costs

☑ A simplified and completely dematerialized relationship with the bank

☑ Automation of exchanges with the bank

☑ International transactions

![AdobeStock_142276396 [Converti] copie](https://wp-axelor.web01-dev-it.axelor.com/wp-content/uploads/2022/07/illu_ebics_03.jpg)

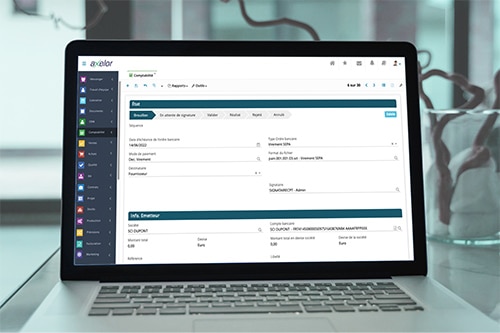

EBICS TS is natively integrated into Axelor

In Axelor ERP, the integration of the validation workflow is included with all required steps to integrate the protocol. These steps involve recovering data, including the retrieval of validation certificates from the bank. Once integrated, the system collects the bank statements. The implementation of the process is done beforehand, according to the company’s needs.

The use of EBICS in Axelor ERP

☑ Direct bank transfers and direct debits from the ERP, without any intermediary

☑ Automatic recovery of account statements

☑ Possibility to make several orders simultaneously

☑ SEPA transfers and international transfers

☑ Transfer of payment and collection files

☑ Electronic signature of payments with acknowledgement of receipt

Our partner banks

Axelor has already implemented the protocol with many banking institutions, and the list is rapidly growing.

☑ BNP

☑ La Banque Postale

☑ Société Générale

☑ Neuflize OBC

☑ Crédit du Nord

☑ CIC

☑ Arkéa

☑ Crédit Mutuel

☑ Caisse d’épargne

☑ Banque Palatine

☑ CACEIS

☑ Banque Populaire

☑ BRED

☑ Crédit agricole

☑ LCL

☑ SOCFIM